Hassle-Free ITR Filing at Just ₹1299! 🚀✨

Tired of complicated tax processes? Our new ITR Filing package, now available for just ₹1299, makes it easy and stress-free! Get expert assistance, fast processing, and maximum deductions—all in one place. Don’t let taxes weigh you down—join thousands of satisfied customers and file your ITR with confidence today! 🌟📝 #ITRFilingMadeEasy #TaxRelief #AffordableTaxService

Yearly GST & ITR Return Filing Combo Offer

Unlock ultimate convenience with our exclusive yearly plan at just ₹3999! Enjoy an entire year of seamless GST Return filing and ITR filing, all in one comprehensive package. With expert support, timely submissions, and unbeatable value, this is the perfect solution for your business. Simplify your tax obligations and save big with this incredible offer. Join our satisfied clients and make tax season a breeze! 🚀✨ #GSTSimplified #TaxEase #YearlySavings #AllInOne

What Is ITR?

ITR stands for Income Tax Return. It is a document that individuals, businesses, and other entities must file with the tax authorities to report their income, expenses, and other relevant financial details for a specific financial year. The primary purposes of filing an ITR are to:

- Calculate Tax Liability: Determine the amount of tax owed to the government based on the reported income.

- Claim Refunds: If excess tax has been paid, filing an ITR allows taxpayers to claim a refund.

- Declare Income: Document various sources of income such as salary, business profits, capital gains, interest, and dividends.

- Compliance: Meet legal requirements to avoid penalties and fines associated with non-compliance.

Filing an ITR typically involves filling out forms specified by the tax authority, which vary depending on the taxpayer’s status and type of income. Accurate and timely filing is crucial for maintaining financial health and complying with tax laws.

Who Should File ITR?

Filing an Income Tax Return (ITR) is mandatory for individuals and entities under various circumstances according to the tax laws in many countries. Here's a general overview of who should file an ITR, particularly focusing on India, as it's a common context for such queries:

- Individuals

Salary and Income Thresholds

- Income Exceeds Basic Exemption Limit: If your total income exceeds the basic exemption limit set by the government (for FY 2023-24 in India, it’s ₹2.5 lahks for individuals below 60 years, ₹3 lahks for those aged 60-80, and ₹5 lahks for those above 80).

- Additional Income: If you have additional sources of income such as interest from savings accounts, fixed deposits, rental income, capital gains, etc., and the total income exceeds the basic exemption limit.

Special Conditions

- Foreign Income or Assets: If you have foreign income or own foreign assets.

- Receipt of Taxable Gifts: If you receive taxable gifts.

- Deposit of Large Amounts: If you have deposited more than ₹1 crore in a bank account.

- High Expenditure: If you have spent more than ₹2 lakh on foreign travel or more than ₹1 lakh on electricity bills.

- Businesses and Professionals

- Business Income: If you have income from a business or profession, regardless of the amount.

- Presumptive Taxation: If you opt for the presumptive taxation scheme under Sections 44AD, 44ADA, or 44AE of the Income Tax Act.

- Companies and Firms

- Mandatory for All: All companies and firms, regardless of whether they have income or losses during the financial year.

- Other Entities

- Charitable and Religious Trusts: Trusts and NGOs claiming exemption under Sections 11 and 12.

- Political Parties: Political parties are required to furnish a return under Section 13A.

- Specific Scenarios

- Loss Carry Forward: If you want to carry forward a loss or claim a refund.

- TDS Claims: If you wish to claim a refund on TDS deducted.

Benefits of Filing ITR

- Legal Compliance: Ensures compliance with tax laws.

- Loan and Credit Card Applications: Helps in processing loan and credit card applications.

- Visa Applications: Facilitates visa processing.

- Carry Forward Losses: Allows you to carry forward losses to future years.

- Claiming Refunds: Essential for claiming refunds on excess tax paid.

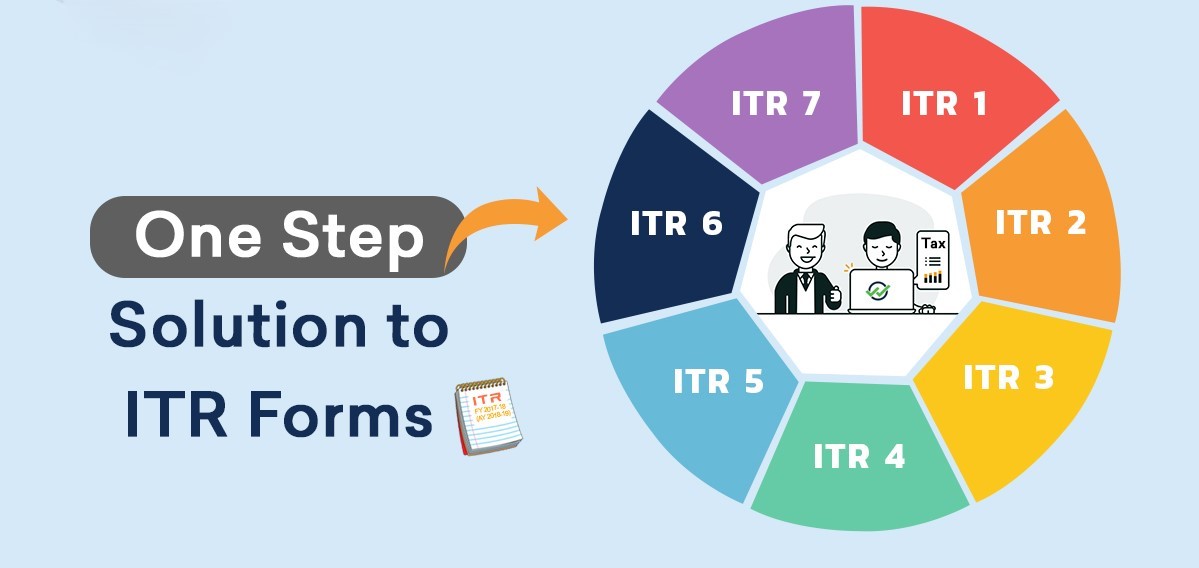

How Many Type of ITRs are there?

In India, the Income Tax Department provides various types of Income Tax Return (ITR) forms for different categories of taxpayers. As of the current tax regulations, there are seven main types of ITR forms:

- ITR-1 (Sahaj):

- For individuals being a resident (other than not ordinarily resident) having total income up to ₹50 lakh, having income from salaries, one house property, other sources (interest, etc.), and agricultural income up to ₹5,000.

- ITR-2:

- For individuals and HUFs not having income from profits and gains of business or profession.

- ITR-3:

- Individuals and HUFs have income from profits and gains of business or profession.

- ITR-4 (Sugam):

- For individuals, HUFs, and firms (other than LLP) being a residents having total income up to ₹50 lakh and having income from business and profession which is computed under sections 44AD, 44ADA, or 44AE.

- ITR-5:

- For persons other than individuals, HUF, companies, and persons filing Form ITR-7 (i.e., partnership firms, LLPs, etc.).

- ITR-6:

- For companies other than companies claiming exemption under section 11 (which pertains to income from property held for charitable or religious purposes).

- ITR-7:

- For persons including companies required to furnish returns under sections 139(4A), 139(4B), 139(4C), or 139(4D (i.e., trusts, political parties, institutions, colleges, etc.)).

Each form is designed to cater to different categories of taxpayers, depending on the nature and amount of their income. Taxpayers must choose the correct form for filing their income tax returns to ensure compliance with tax regulations and avoid penalties.

Penalty for Late ITR

Filing an Income Tax Return (ITR) late in India can lead to several penalties and consequences. Here are the key points regarding the penalties for late filing of ITR:

- Late Filing Fees under Section 234F:

- For returns filed after the due date but before December 31st of the assessment year, a late fee of ₹5,000 is applicable.

- For returns filed after December 31st but before March 31st of the assessment year, a late fee of ₹10,000 is applicable.

- For taxpayers with a total income of up to ₹5 lakh, the late fee is restricted to ₹1,000.

- Interest under Section 234A:

- If there are any unpaid taxes, interest at the rate of 1% per month or part thereof is levied on the outstanding tax amount from the due date of filing till the actual date of filing.

- Loss of Interest on Refund:

- If you are due for a refund, you may lose the interest on the refund amount for the period of delay in filing the ITR.

- Delay in Carry Forward of Losses:

- Losses under the head “Capital Gains” and business losses cannot be carried forward if the ITR is filed after the due date. However, losses from house property can still be carried forward.

- Penalty under Section 271H:

- In cases where the tax authorities find that the late filing of the ITR is deliberate or to conceal income, an additional penalty may be imposed. This penalty can range from ₹10,000 to ₹1,00,000.

- Prosecution under Section 276CC:

- If the taxpayer willfully fails to file the return, especially if the tax payable is significant, they could face prosecution. This could lead to imprisonment ranging from 3 months to 2 years, and in cases where the tax evaded exceeds ₹25 lakh, the imprisonment could extend to 7 years.

It’s crucial to file your ITR on time to avoid these penalties and complications. If you miss the deadline, you should aim to file your return as soon as possible to minimize penalties and interest charges.